This award recognises funders deploying capital in innovative ways to enable impact investing. Philanthropists, donors, high net-worth individuals, trusts and foundations are eligible.

Innovation Edge

Background

Innovation Edge is an impact investment firm in South Africa that fosters innovative solutions to early childhood challenges. Founded in 2014, the firm was created through a collaborative effort of several organisations, including the Omidyar Network, the UBS Optimus Foundation, the DG Murray Trust, the FirstRand Foundation, and the ELMA Foundation. Innovation Edge supports entrepreneurs and social innovators to develop, test, and scale solutions that address childhood challenges. It provides tailored support and takes on the risk of early-stage opportunities. Indeed, a key metric for Innovation Edge is its ability to de-risk these nascent opportunities and enable third-party follow-on funding, while establishing key partnerships with organisations and evidencing the most appropriate form of sustainability for those opportunities. In its first year alone, Innovation Edge invested in 22 organisations in South Africa and successfully transitioned four proof-of-concept innovations to scale.

Originality of design

Innovation Edge identifies focus-aligned organisations and supports them throughout their entrepreneurial journey. The support they offer depends on the operational phase of an early-stage organisation and falls into two main categories: (1) ECD Catalyst and (2) Venture Build. ECD Catalyst provides funding to promising early childhood development ventures, whereas Venture Build is an accelerator programme that supports ventures that have already demonstrated proof of concept. The company leverages various channels to identify potential investees, including open applications, themed campaigns, and origination through their networks. Additionally, through what they describe as “hands-on backing”, Innovation Edge accompanies investees through their entrepreneurial journey: from ideation to proof-of-concept to scaling. This engagement fosters a nurturing ecosystem that enhances the probability of both operational and social outcome success for the initiatives and organisations they support.

Meeting unfilled needs

As indicated above, Innovation Edge addresses critical challenges in the ECD sector by focusing its investments and support on start-up or early-stage ventures that are positioned to transform children’s lives. With 49 investments amounting to R46m, the firm has leveraged an additional R111m. Of the initiatives they have invested in, 23 are tech-enabled, while others focus on child protection and healthcare. Their financial and non-financial support, particularly for emerging enterprises, catalyses change and lays the groundwork for these organisations to attract subsequent rounds of funding and partnerships.

Theory of change

Innovation Edge operates on a well-defined theory of change (ToC) to mitigate ECD challenges in South Africa, such as poverty, inequality, and limited access to quality services. The theory is underpinned by two central dimensions:

- Impact on the investee: This dimension concentrates on the commercial success and sustainability of the organisations supported by Innovation Edge.

- Impact through the investee: This dimension focuses on the social and behavioural outcomes achieved in the focus areas, measuring the scale and sustainability of the impact on the beneficiaries.

The ToC is articulated through a sequence of inputs, activities, outputs, outcomes, and ultimately, impact, demonstrating both “impact on the investee” and “impact through the investee”. The figure below provides a brief overview of Innovation Edge’s ToC, with key inputs and activities and how the success of these interventions is measured.

| Inputs | Activities | Success measured by: |

|---|---|---|

|

Searching for innovators solving ECD challenges |

|

| Investing in early-stage ventures using custom financial instruments |

|

|

| Connecting investees to partners to support and expand their work |

|

|

| Work with funders to increase the pool of funding for ECD |

|

|

| Support ECD organisations to connect with each other |

|

|

| Develop pool of ECD evidence through impact stories |

|

|

| Develop pool of evidence by contributing to ECD measurement ecosystems |

|

|

| Contribute to pool of ECD evidence by facilitating research |

|

The outputs and outcomes of these activities focus on, as mentioned, the impact on the investee and the impact through the investee. In terms of the impact on the investee, interventions are primarily geared toward enhancing investees’ viability and readiness for follow-on funding. This is achieved through a multidimensional approach that includes:

- Strengthening the investees’ business models for better market fit and financial sustainability

- Assisting in the development of sustainability plans to ensure long-term viability

- Enhancing governance and leadership within the investee organisations for effective decision making

- Improving their ability to measure and demonstrate social and financial impact

- Helping to craft and implement viable strategies for scaling impact

- Refining the unique value proposition (UVP) and go-to-market strategies to better reach target audiences

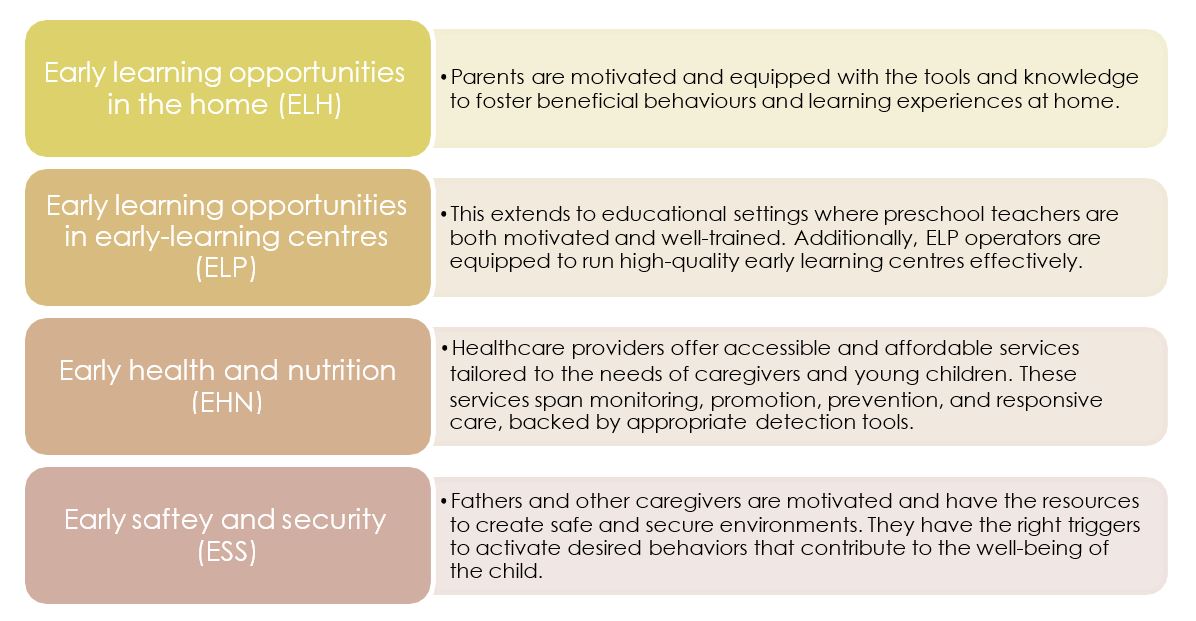

On a broader scale, the investee’s work leads to positive changes in early learning opportunities in homes, quality early learning programmes, early health and well-being and early security and safety. These outcomes are modelled on the World Health Organisation (WHO)’s guideline on the components for Nurturing Care. The figure below outlines these components and how they inform the desired outcomes of Innovation Edge’s ToC as it pertains to impact through investees.

In summary, the impact through the investee aims to create an ecosystem where every stakeholder in a child’s life from parents to educators to healthcare providers is empowered to contribute positively to early childhood development.

Impact thesis

Innovation Edge operates on the belief that targeted, patient capital can catalyse transformative change in ECD. By offering both financial and non-financial support, Innovation Edge aims to incubate and accelerate nascent social enterprises committed to ECD innovation. This focused approach enables these enterprises to unlock sustainable commercial value while making a marked impact on ECD outcomes. They achieve this by equipping parents, caregivers, and healthcare workers with pioneering products and services tailored to critical ECD needs. The organisation posits that its presence as a patient capital provider in the ECD landscape enables it to serve as a magnet for entrepreneurial innovators. This, in turn, injects dynamism and ingenuity into the sector, fostering a virtuous cycle of investment and impact. By acting as a catalyst in this ecosystem, Innovation Edge aspires to create a ripple effect of positive change that extends from individual families to communities and, ultimately, the larger society.

Linkages to global frameworks

Innovation Edge focus on ECD is aligned with Sustainable Development Goal (SDG) 4, “Quality Education” and in particular, 4.2.1. that focuses on ensuring that children under the age of five are “developmentally on track in health, learning and psychosocial wellbeing”. By investing in and nurturing social enterprises aimed at improving ECD outcomes, Innovation Edge is making targeted efforts to uplift and transform the developmental trajectories of young children in South Africa.

Furthermore, as mentioned in the previous section, the company’s investment portfolio is also guided by the WHO’s guidelines on the components of nurturing care that are aligned with SDGs. These include good health, adequate nutrition, responsive caregiving, security and safety and opportunities for early learning.

As such, apart from targeting SDG4, the support for community healthcare workers targets SDG 3; Innovation Edge’s focus on equipping parents, caregivers and healthcare workers with innovative ECD products and services is reflected in these components, promoting not just physical health but also cognitive, linguistic and socio-emotional development.

Impact

Since its inception in 2014, Innovation Edge has curated an impressive investment portfolio, with a focus on multiple facets of ECD. To date, the firm has made 49 targeted investments totalling R49m and has successfully leveraged an additional R111m. These investments align with the Nurturing Care components as discussed above, which form the basis of the investment strategy.

Central to this strategy is a multi-tiered monitoring framework designed to assess impact at various stages of an investee’s innovation lifecycle. At the reach stage, the initiation traction and beneficiary engagement are evaluated. The effect stage involves monitoring the efficacy of interventions, typically through pilot programmes. The final sustain stage tests the intervention’s long-term viability by observing its implementation without active oversight.

Innovation Edge’s portfolio highlights a multi-dimensional approach to ECD, spanning four categories:

Motivating caregivers: These investments are linked to the ELH component and include initiatives such as MomConnect, a free, informative and stage-based messaging platform for pregnant women as well as Finding Thabo, an interactive brain-building game that can be used with social media. This segment of Innovation Edge has had the following results:

- Reach: 2,240 young children have been reached with responsive caregiving

- Effect: 2,240 caregivers were empowered and motivated

- Sustain: Four social enterprises sustainably provided resources and tools to caregivers in the home

Supporting community healthcare workers: This segment of Innovation Edge’s portfolio aligns with the EHN component and entails innovations such as HearScreen and Vuna. HearScreen is a mobile health solution that uses a smartphone application to screen young children for hearing loss. Designed to be used in early learning centres and schools, it does not require expensive equipment or medical professionals. Vuna is a psychosocial support service aimed at pregnant women and parents of young children, which is delivered either in-person or via WhatsApp Business. These investments have delivered the following outcomes:

- Reach: 5,300 children and their caregivers had access to screening and support services

- Effect: 265 community healthcare workers were motivated and supported

- Sustain: Three social enterprises sustainably increased services to young children and their caregivers

Empowering ECD teachers: This focus is linked to the ELP component and encompasses investments such as MathsUp and Earlybird Educare@Work. Mathsup is an app used by Grade R teachers to access mathematics content to help their teaching practice, while Educare@Work is a social enterprise building a network of early childhood care and education centres across the socioeconomic spectrum in South Africa. A fixed portion of the revenue generated from the latter is used to subsidise the provision of the same ECD model at preschool centres in low-income communities. These interventions have had the following outcomes thus far:

- Reach: 44,360 young children were enrolled in ELPs with improved quality

- Effect: 4,515 women were empowered and motivated

- Sustain: Seven social enterprises sustainably provided resources and tools to ELP practitioners and operators

Actively engaging fathers aligns with the ESS component of the WHO’s Guidelines on Nurturing Care and focuses on creating a conducive environment that increases the involvement of fathers in ECD. Innovation Edge has invested in an innovation called “Fathers Matter ECD”, a programme that provides ECD practitioners with resources and techniques to encourage father participation in early learning. So far, this programme has delivered the following outcomes:

- Reach: 215 young children have fathers (which includes all male caregivers) content on being present and engaged with them

- Effect: 215 fathers (all male caregivers) are motivated and supported

- Sustain: Two social enterprises sustainably increased the understanding of why fathers (all male caregivers) matter in the early years

Looking ahead to 2023-2025, Innovation Edge aims to establish ECD as a legitimate asset class for impact investment, targeting an impact on 160,000 children.

To ensure accountability and progress, investees submit quarterly and milestone-linked reports. The milestones are set based on data from the “reach” stage and industry insights. A unique feature of their impact assessment is the requirement for pre- and post-intervention surveys, focusing on behavioural change as an indicator of long-term impact. Upon project completion, a comprehensive final report aids in determining the potential for follow-on investments or broader investor engagement. These assessments are shared as impact stories and insights are disseminated through newsletters, blog posts and other knowledge products.

Financial performance

Innovation Edge is currently donor funded. These funders are categorized as core and programmatic donors. Core donors cover the firm’s operating costs in addition to their capital outlay with respect to their investment functional areas. The company leverages their grant income impressively and secured more than R35m in 2021, a substantial increase compared to approximately R31m the previous year. In an effort to legitimize ECD as an impact investment asset class, Innovation Edge has set ambitious targets for 2023-2025, aiming to reach and impact 160,000 children. The long-term vision includes the launch of the IE Ventures Fund to attract additional investors.

Potential for replicability

Innovation Edge’s approach to tackling social challenges, particularly those affecting young children, demonstrates several elements that have the potential for replicability. In particular, its targeted support through funding windows – ECD Catalyst for funding promising early-stage ventures, and Venture Build as an accelerator for those with proof of concept. This approach allows Innovation Edge to cater to organisations at different stages of the innovation lifecycle, providing tailored resources and mentorship that could be valuable across diverse sectors and geographies.

The modular nature of Innovation Edge’s programmes like ECD Catalyst and Venture Build offers a framework that could potentially be replicated. ECD Catalyst’s focus on early-stage ventures fills a critical funding gap that exists in many sectors, not just ECD. Similarly, the Venture Build accelerator programme, designed for ventures that have already demonstrated proof of concept, provides the kind of advanced support that could be crucial in scaling solutions in multiple fields.

By focusing on specific needs at specific stages, Innovation Edge’s model provides a blueprint that can be adapted to address a range of social challenges in various contexts. This targeted and stage-sensitive support could be a game-changer in places where similar issues exist but are exacerbated by the absence of dedicated, expert-backed initiatives.

However, there are several barriers that undermine the replicability of the model.

First, Innovation Edge is currently funded by donors. While this has provided robust financial backing for its operations and investments, this donor dependency could be a limiting factor in scaling or replicating the model. Additionally, the patient capital investment strategy demands a long investment horizon, which may discourage other potential investors who are looking for quicker returns, particularly in an environment where high-risk capital is scarce.

Secondly, the ambition to position ECD as an impact investment asset class by 2025 requires not only considerable financial resources but also a shift in investor sentiment to appreciate the long-term value of investing in ECD. Finally, Innovation Edge’s unique value proposition of providing both financial and non-financial support could be difficult to replicate without similar ethos and expertise in potential successor organisations. Despite these challenges, Innovation Edge is forging a path that could be emulated by other organisations. While exact replication may not be feasible due to these constraints, elements of its specialised programmes for early-stage and more mature ECD ventures offer valuable lessons for other impact-driven entities.

Risks

Donor dependency: Innovation Edge relies heavily on donor funding. This creates a risk of operational instability if donors pull out or change their funding priorities.

To address this risk, Innovation Edge must explore ways to diversify its funding sources or develop long-term partnerships with more organisations that align with its mandate.

Market and economic risks: There are several market-related challenges that pose a risk to Innovation Edge’s operations. These include the lack of high-risk capital providers in South Africa as well as the long investment horizon required for the kinds of projects that Innovation Edge supports. This can undermine the scalability and impact of the interventions. Relatedly, economic instability, such as inflation or currency devaluation could escalate the operational costs of running programmes.

A comprehensive approach is required to mitigate these risks. For market-related risks, blended financial models that combine various types of financing to absorb initial shocks and provide a more sustainable path to profitability can be explored. To address economic risks, fixed-rate contracts with certain providers can mitigate some of the risks of economic fluctuations, alongside contingency plans in budgeting to accommodate economic uncertainties.

Data integrity: Inaccurate or insufficient data collection poses a risk to Innovation Edge’s investments, as it could lead to incorrect assessments of a programme’s effectiveness and impact. In the absence of reliable data, stakeholders may find it challenging to gauge the value of the initiatives, which could in turn affect future funding and support.

Mitigating strategies to address this risk may include:

- The implementation of robust data collection protocols that are aligned with the programme’s goals to ensure that all essential data is captured accurately

- Conducting periodic data audits to identify and correct any gaps or inaccuracies in the collected data

- Partnering with monitoring and evaluation firms to validate the data collection process and results

- Training staff involved in data collection to ensure consistency and accuracy in the methods used

Share

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.