This award is for innovative financial instruments that form the underlying structure for impact investments including, for example:

- funding instruments aimed at institutional funders;

- impact delivery instruments to separate out innovation at large-scale funding level; and innovation in lending schemes to targeted beneficiaries

27four Investment Managers: The Black Business Growth Fund II

Company27four Investment Managers: The Black Business Growth Fund IIFounding date27four – 2007; BBGF – 2019GeographySouth AfricaSectorFinancial servicesSDGs1 [no poverty], 3 [good health and wellbeing], 4 [quality education], 5 [gender equality], 8 [decent work and economic growth], 10 [reduced inequalities]

Background

27four is a black female-owned multimanager with a strong track record accumulated over a decade of operating in the financial services sector.

Originality of design

27four developed a blended finance solution to deliver both commercial returns and impact such as job creation, transformation and economic growth for investors. The 27four Black Business Growth Fund II (BBGF II) raised grant funding from the Jobs Fund and retirement fund commitments. The primary focus of the BBGF II is to support emerging black private equity managers (BPEMs) with a focus on growth investing. The BBGF II makes commitments to emerging South African small and medium-sized enterprises (SME) and mid-market BPEMs, and similar investment vehicles. The fund also makes commitments to co-investments with a focus on growth capital investing. The BPEMs identified will be black-owned and managed, with the ethos of transforming the companies in their portfolios embedded in their respective investment strategies.

Meeting unfilled needs

The Jobs Fund funding provides subordinated capital which serves as downside protection for retirement funds backing emerging BPEMs instead of established managers. The Jobs Fund capital is comingled with retirement fund capital on deployment into BPEM funds but ranks behind return of capital and an agreed hurdle to retirement fund investors, thereby providing the requisite downside protection.

The unique downside protection mechanism:

- Provides up to 20% downside protection buffer to retirement funds, equivalent to a single commitment to one underlying BPEM

- Reduces the J-curve with the normal initial dip covered by the Jobs Fund

The project (BBGF II) considers the underlying fund’s objectives on the transformation of its portfolio companies and whether actual objectives/targets are included in its mandate and in contracting with portfolio companies.

Theory of change

If the BBGF II invests financial, human, intellectual, and social and relationship capital in black private equity fund managers then its number and the rand value of funds invested in portfolio companies will increase.

Impact thesis

At inception the project aimed to onboard six to seven BPEMs, indirectly investing in 40 to 50 portfolio companies by the end of the first quarter of 2024/25. The project expects to disburse R200m from the Jobs Fund alongside R1bn in matched funding.

SDG linkages

The BPEMS BBGF II invests in have committed themselves to driving transformation in their investee companies with a focus on increasing the representation and voice of women at all levels in companies. Additionally, most of the jobs the fund has created are occupied by women.

The jobs created by managers and their investee companies all meet labour law requirements for decent work in South Africa. All jobs except those based on commission meet minimum wage requirements as prescribed by the Department of Employment and Labour.

Through the creation of sustainable permanent jobs, the investments BBGF II has contributed to in turn contribute to the reduction of inequalities in South African communities by giving African – especially indigenous – people access to economic power and leverage.

By contributing to the creation of sustainable permanent jobs and short-term jobs, BBGF II is contributing to eradicating poverty in South Africa.

The project has invested in a primary and high school group that caters to lower and mid living standards measure communities in Bloemfontein. The project also contributed to the construction of a school in Fourways, Johannesburg. This is in addition to support extended to a tertiary institution seeking to expand to the African market.

The project has contributed to make investments in the healthcare sector with the outcome being an increase in access to quality healthcare in Soweto, Gauteng and Louis Trichardt, Limpopo.

Impact

This project aims to tackle three problems currently affecting BPEMs and, more broadly, employment levels in South Africa:

- The private equity industry is not

- First time and emerging highly qualified and experienced black managers have limited or no private equity fund management track records and therefore struggle to raise capital compared to established

- Job creation and transformation of the wider economy is not advanced in South

The primary aim of investments by the Jobs Fund is linked to job creation while limited partners (LPs) or matched funders mainly concern themselves with returns. The project accelerates the funding available for black businesses for the purpose of job creation, transformation and wider socioeconomic impact. The BPEMs are required to infer black ownership and drive transformation through their investments in line with regulatory considerations.

Outcome indicators

- Employment creation

- Number of new permanent full-time positions/jobs

- Number of new short-term full-time positions/jobs skills development

- Number of trained beneficiaries (completed training)

- Economic growth

- Value of management fee (revenue) paid to BPEMs and due diligence fees paid to third-party service providers

- Number of portfolio companies invested in by BPEM funds

- Number of BPEMs achieving annual transformation targets as set out in the Amended Financial Services Sector Codes

- Number of BPEMs supported through funding

- Number of BPEMs reaching first close

- Number of BPEMs reaching final close

- Operations matched funding ratio

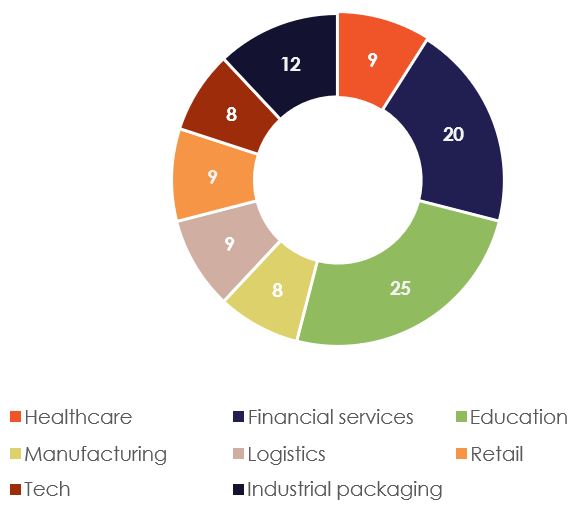

Figure 1: BBGF II sector exposure by percentage

The fund has performed very well to date (since inception in July 2019), with the net internal rate of return (IRR) and TMB at 18.3% and 1.27x. As of 28 February 2023, the BBGF sector exposure was as follows:

As of 27 March 2023 there had been 547 new permanent jobs created through the project. Job creation is verified annually by an independent auditor. New permanent job creation spans all nine provinces of South Africa, with most of the jobs being occupied by black women and skilled and semi-skilled individuals. The project has also created 218 short-term jobs from inception to date. These short-term jobs indicate the project’s ability to give initial exposure to an industry for individuals without access to permanent jobs, allowing them to accumulate experience they can use in their search for permanent employment. The short-term jobs are also largely occupied by black women. The project has maintained an average ratio of

1.55 new permanent jobs created per R1m of capital drawn into the BBGF II. The project has also assisted managers with nonfinancial support. This included:

- Assisting managers with fundraising in the market (only postconditional commitment)

- Contracting terms improvement for retirement funds

- Deal reviews and challenge provided to managers on how institutions look at re-mandate fit

- Warehousing to build track record

- Team and individual contributor sourcing

- Improvement in due diligence processes

- Limited Partnership Agreement guidance and support

- Advisory board guidance around governance

- Due diligence processes with others providing insight into how to approach analysis

- Impact investing and ESG support

- Reporting improvements

- Marketing

Financial performance

Table 1: Financial performance of BBGF II

| Total distributions to investors | – |

| Number of investments funded | 5 |

| Number of co-investments | – |

| Number of underlying portfolio company investments | 14 |

| Number of exists/partial exists | 1 |

| Cost of current investments | R280,876,813 |

| Fair value of current investments | R380,464,474 |

| Total net asset value of the fund to partners | R365,024,945 |

| Total net asset value of the fund to partners (after Jobs Fund first loss) | R373,155,099 |

Potential for replicability

The exposure of BBGF II in multiple sectors indicates the potential of the replicability of the model across different sectors. The model has resulted in the creation of jobs in different provinces in South Africa. This points to the potential replicability of the model in other markets.

Risks

The project has faced several challenges including the long and often opaque processes of asset consultants and retirement funds, which have resulted in protracted deployment rates across BPEMs in the portfolio.

Click here to download the case studyShare

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.