This award recognises impact hubs (for example incubators, accelerators) that are financially sustainable and that provide support to emerging social enterprises in the form of capacity building/catalytic funding as well as connect social enterprises with impact investors. Hubs create opportunities for impact investors to invest and social enterprises to attract capital.

Capital Solutions Limited

Background

Capital Solutions Ltd (CSL) is a social enterprise which aims to inspire, transform and build the capacity of social entrepreneurs working with low-income communities in Africa. CSL was formed out of the need to build sustainable social enterprises through improved financial accessibility and to design innovative and impactful solutions.

Originality of design

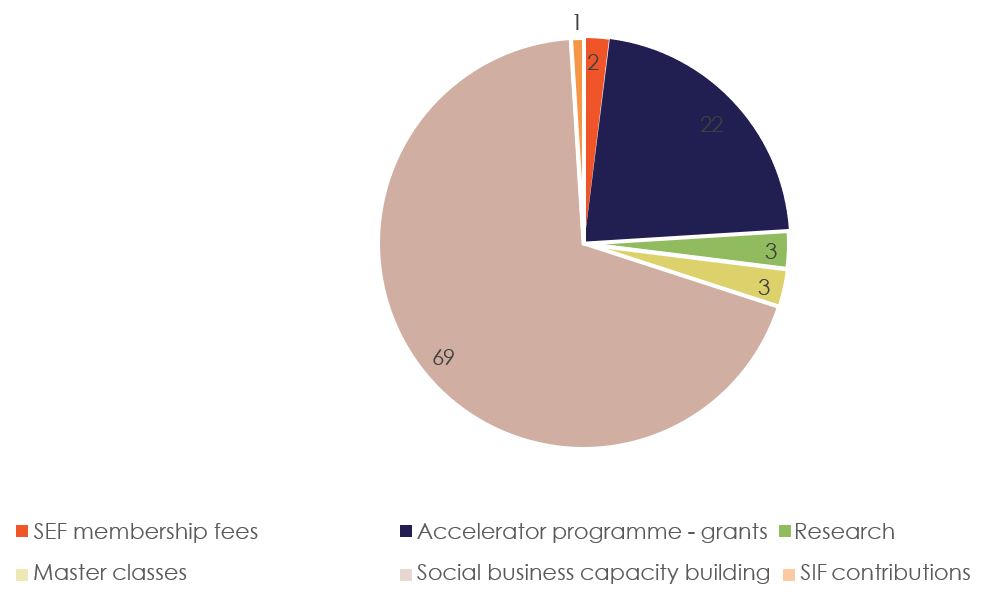

CSL has four revenue streams:

1. The Social Entrepreneurship Forum (SEF)

The forum generates revenue through annual subscription fees. The SEF was launched in July 2020 to improve networking among social entrepreneurs in Africa to grow their businesses, increase financial accessibility and establish a unified voice to push for advocacy/policies. Its target sectors include education, health, agriculture, financial services, information technology, transport & logistics, fashion & tourism, climate change and others.

2. Advisory services

The Advisory services unit offers business development services to social enterprises, NGOs and private sector companies through capacity building in business development services, research, business planning, strategic planning, mid-term and end term evaluations, project management and implementation and social enterprise development through CSL’s tailor made models.

3. The Social Business Accelerator Programme

The programme generates revenue through admission fees and funded projects. It is a six-month programme that aims to enhance local social enterprises’ capacities, promoting business resilience and sustainability while preparing them for business growth opportunities. The programme helps social entrepreneurs scale up their work through the design-thinking approach, innovation and business modelling training for beneficiaries. This is tailored towards the need for social enterprises to reform their businesses models and develop products and services that are needed in the market. Beneficiaries are also supported through mentorships to ensure application of learning outcomes.

This is in addition to expert guidance to enable them to navigate bottlenecks in their respective businesses.

4. The Social Investment Fund

Capital Solutions established the Social Investment Fund (SIF) in January 2020 as an impact fund for small and medium-sized enterprises (SMEs) based in Africa to improve their access to finance. SIF targets women-led and youth-led social enterprises and provides small amounts of private debts, marginal grants, equity and capital, ranging from $500 to $5,000. This supports promising start-ups and scale ups (one to five years).

Meeting unfilled needs

Through the accelerator programme, Capital Solutions seeks to reduce the gender gap in business growth and sustainability between youth, male and women-led businesses by providing learning space, access to gender-based investors and profitable markets as well mentors to support women-led enterprises to scale for high social impact. Moreover, SIF finances social enterprises operating in a financially constrained environment in which they cannot access financing from the mainstream financial circles. As it addresses challenges such high youth unemployment, SIF contributes to SDGs 1, 5 and 8.

Theory of change

If CSL empowers social enterprises with the necessary skills and financial resources to achieve sustainability, then more such enterprises will be able to continue providing various essential services especially to low- income African communities.

Impact thesis

To resolve the challenge of limited access to finance, Capital Solutions improves financial accessibility for social enterprises through the investment fund. CSL also helps improve the sustainability of social businesses by providing capacity building courses through the Social Business Accelerator Programme to help businesses scale.

SDG linkages

Impact

The impact CSL has made:

- 6,950 social entrepreneurs connected through its online platform

- 265 women-led organisations trained and empowered to achieve financial sustainability

- 267 social businesses scaled

- 365 organisations trained

- 100 SEF members

- 80% women employed

- 265 young people employed

- 365 businesses scaled

- 20 business-to-business partnerships

Financial performance

Figure 1: CSL 2021 revenue sources (%)

Source: CSL

Potential for replicability

The wide range of sectors that CSL targets through the Social Entrepreneurship Forum provides an indication of the potential of the model to be transferred to different sectors. Moreover, the services that CSL provides are needed in several African countries, where social entrepreneurs play a significant role in the lives of communities.

Risks

The CSL board established a risk management system to identify, assess, manage and monitor risks that would threaten the existence of CSL or negatively affect its achievement of strategic objectives. The system includes:

- Business continuity plan: this addresses operational risks and strives to minimise any threat posed by shortcomings or failure of internal processes and systems, as well as external developments such as natural disasters

- Stakeholder engagement: CSL has good governance structures which demand active engagement with stakeholders to achieve strategic These interactions help the company better manage expectations, risks, innovations and process improvements

Share

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.