This award recognises impact hubs (for example incubators, accelerators) that are financially sustainable and provide support to emerging social enterprises in the form of capacity building/catalytic funding and connect social enterprises with impact investors. Hubs create opportunities for impact investors to invest and social enterprises to attract capital.

LEAP Africa Social Innovators Programme

Background

The Social Innovators Programme is organised by LEAP Africa and provides skills, resources and connections for young innovators on the African continent to create lasting solutions to community challenges. Fellows are culled from different countries and taken through interventions that help them build sustainable systems and structures. Fellows work across various industries such as education, agriculture and food security, renewable energy and sustainable environments, education and technology.

Originality of design

The programme targets industry-specific corporate sponsorships of fellows. Over the past 10 years, the project has enjoyed sponsorship from local partners, making it free of charge to the participants. As LEAP Africa continues to build an ecosystem of more interested investors and social development partners, the model will incorporate registration fees which participants will be required to pay, albeit subsidised.

Meeting unfilled needs

LEAP Africa’s Social Innovators Programme (SIP) is an accelerator fellowship, which, through a holistic approach, empowers young changemakers and helps them build their capacity, connections and credibility. It was born out of the understanding of the challenges faced by most young social enterprises such as early-stage funding, resources and market access that hamper their growth and sustainability.

The SIP fellowship exists to support the growth of innovative youth-led social enterprises by:

- Building their capacity through trainings, mentoring, advisory and coaching support

- Connecting them to global networks and partnerships

- Showcasing their innovations through conference/awards and media promotions

Theory of change

Equipping youth with good leadership skills will enable Africa to produce transformative leaders.

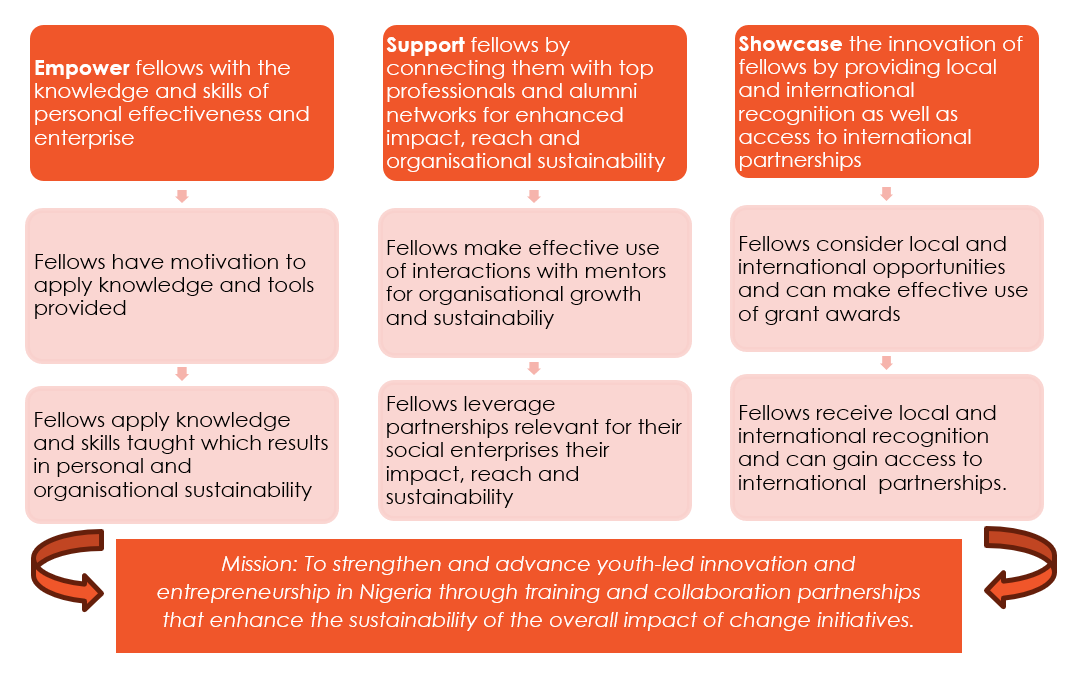

The figure below illustrates how the programme activities link to the expected outcomes in a stepwise progression for the fellows. As seen by their involvement in the sustainability workshop and other activities, the project will ultimately translate into the fellows becoming change agents.

Figure 1: Theory of Change for LEAP Africa’s SIP

Impact thesis

SIP aims to bridge the gap between social innovators or entrepreneurs and their goals. The intervention focuses on:

- Equipping young businesses and entrepreneurs to build sustainable enterprises.

- Supporting them by connecting them with mentors, helping them forge new partnerships and putting them in touch with investment opportunities.

- Showcasing the innovations and solutions that they devise for the various problems that confront the communities where they operate.

SDG linkages

LEAP Africa’s work addresses SDGs 4 (quality education); 8 (decent work and economic growth); 10 (reduced inequities) and 17 (partnerships for the goals).

Impact

The evaluation of the SIP is informed by the results-based framework and theory of change. This approach emphasises continued reflection on how to improve on outputs and impact, while also reporting all these to its clients, partners and donors in formats that meet global standards.

The evaluation employs a mixed-method approach to triangulate quantitative and qualitative data sets. In conducting the evaluation, the monitoring & evaluation tools and techniques utilised during the programme are:

- Data collection

- Baseline and end-line surveys

- Feedback forms

- Focus groups discussions

Between 2013 and 2022, the programme has had 276 fellows in 14 different countries. Cumulatively, the impact numbers and reach of fellows’ social enterprises have grown by 80%, and 97% of fellows have formally registered their ventures and instituted a board of directors. The programme has reached over 4-million indirect beneficiaries. In the last five years while fellows’ social enterprises have employed over 400 people across Africa. Leap Africa has raised over $6m in funding and revenue.

The programme provides skills, resources and connections for young innovators in Africa to create lasting solutions to community challenges. It targets industry-specific corporate sponsorships of fellows.

The table below demonstrates how the SIP achieves additionality. It depicts the difference that interaction with the programme’s three areas of focus (learn, support, and showcase) makes to fellows and their enterprises.

Table 1: Impact of LEAP Africa’s SIP

| Input | Activity | Output | Outcome | |

| Learn | Online call for application

Fellow selection Induction of fellows Curriculum review Select Faculty |

Organise a six-day virtual workshop for 40 pan-African fellows | 40 fellows are equipped with skills, knowledge, and tools required to run successful and sustainable social enterprises | Fellows have a raised aspiration about their social enterprises which culminates in improved personal effectiveness and organisational sustainability |

| Support | Identifying mentors

Identify/notify partners and investors Identify/notify alumni |

Mentor matching

Networking with partners and investors |

Fellows interact and learn from mentors

Selected fellows are supported with partnership building and investment |

Fellows leverage on partnerships relevant to their social enterprises to enhance its impact, reach and sustainability. |

| Showcase | Fellows evaluation

Identifying judges Story board Online platforms |

Awards event

Documentary Online visibility |

Three outstanding fellows are recognised and awarded

Fellows are provided with visibility and exposed to potential funding and support opportunities |

Fellows are locally and internationally recognised social innovators and are able to gain access to international partnerships |

The intervention has not had negative impacts or consequences but has overcome some initial problems. The programme was initially built around capacitating entrepreneurs, mainly with skills, structures and systems to enable them to thrive. However, the entrepreneurs needed more than just capacitation and began asking about opportunities to be connected with investors. That led to an adjustment of the model as LEAP Africa had to ensure that the “showcase” component of the programme brought entrepreneurs’ work to the attention of potential investors who would help scale their impact.

The intervention has gone beyond achieving the minimum requirements. Over the years, the programme has been administered to 284 social entrepreneurs from 14 African countries who have been able to collectively attract about $7m in grant funding and hire over 400 employees who were previously unemployed. Moreover, several enterprises that have been part of the programme now have boards of directors and strong corporate governance systems in place.

Financial performance

The enterprise has raised over $6m in funding and revenue. Revenue consists of grants and donations.

Click here to download the case studyShare

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.