This award is for impact-oriented investment houses placing or allocating impact capital.

Phatisa

Background

Phatisa is a pioneering African private equity fund manager with a unique investment approach that blends commercial acumen and social impact. Founded in 2005, Phatisa has carved out a specialised niche for itself by focusing on the African food value chain and affordable housing sectors. Rooted in the belief that true success is measured not just in monetary returns but also in the value created for society at large, Phatisa has demonstrated an unwavering commitment to sustainable and impactful investment practices.

Originality of design

Phatisa’s design as an asset manager is grounded in its unique philosophy of “and” – a focus on achieving both commercial and societal benefits without compromise. With nearly half a billion dollars under management, Phatisa distinguishes itself by refusing to see a trade-off between impact and returns. In fact, the ampersand (&) at the heart of its brand embodies this core principle. Phatisa’s business model demonstrates how better financial performance can correlate with greater societal impact. For example, at Meridian, a fertiliser manufacturer, its investment not only yielded a remarkable exit multiple but also significantly ramped up production and bettered the lives of more than 53,500 smallholder farmers. This dual-track success is a compelling departure from conventional investment strategies, firmly establishing Phatisa as an original and groundbreaking asset manager.

Meeting unfilled needs

Phatisa has strategically positioned itself as an asset manager that addresses the most pressing and often overlooked needs in African communities. With a targeted focus on the food value chain and affordable housing, Phatisa recognises the vital role these sectors play in the day-to-day lives of the African populace. For instance, through its work with Meridian, Phatisa has not only increased production but also carried out 3,000 soil tests, which informed the creation of bespoke fertiliser blends. These actions led to a tangible increase in crop yields – up to 30% in maize. Moreover, Phatisa’s advocacy efforts succeeded in revising an outdated voucher system in Malawi, enabling farmers to access the appropriate fertiliser blends. Through such intentional interventions, Phatisa is fulfilling both immediate and long-term needs, contributing to systemic changes that leave a lasting impact on communities.

Theory of change

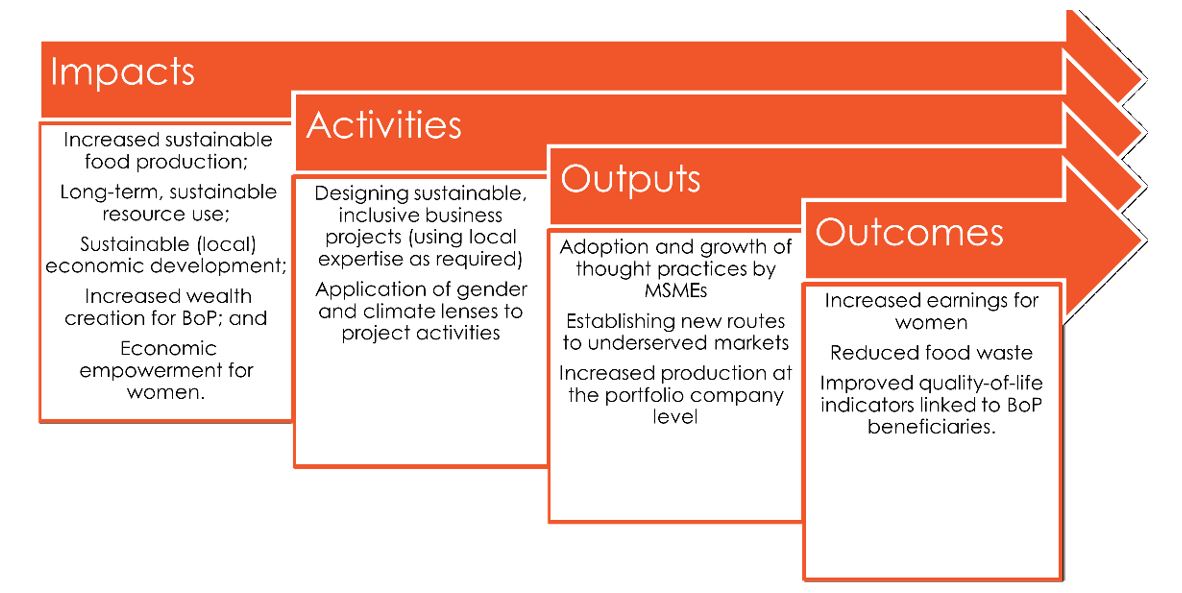

Phatisa’s theory of change is a critical component of its Impact Measurement and Management (IMM). It demonstrates the interventions and actions which are necessary to bring about intended outcomes and impacts, primarily the building of sustainable food systems. Inputs and activities are provided and undertaken by Phatisa, its investors, portfolio companies and other key partners, such as consultants and contractors. Fund-level impact databases (excel support documents to the IMM) provide the indicators/metrics which are used to measure each step in the theory of change and are therefore designed to prove a certain impact hypothesis, which is detailed in the theory of change. Having detailed and carefully considered theories of change with good, internationally accepted indicators (IRIS+, HIPSO, JII) enables Phatisa to make a solid and defendable impact case.

For example, Phatisa’s sustainable food systems theory of change details the following impacts:

- increased sustainable food production;

- long-term, sustainable resource use;

- sustainable (local) economic development;

- increased wealth creation for BoP; and

- economic empowerment for

Key activities include, for example, designing sustainable, inclusive business projects (using local expertise as required) and the application of gender and climate lenses to project activities. Outputs (expected over six to 12 months) include the adoption and growth of thought practices by smallholders and micro, small and medium enterprises (MSMEs), establishing new routes to underserved markets and increased production at the portfolio company level. Finally, outcomes which lead to the demonstration of intended impacts, including increased earnings for women, reduced food waste and improved quality-of-life indicators for linked bottom-of-the-pyramid (BoP) beneficiaries.

The impact measurement plan accompanying each theory of change specifies what data will be collected, how and by whom, bringing an additional layer of rigour and accountability. Moreover, under specific circumstances, results are adjusted for attribution, aligning with best practices as outlined by Impact Frontiers.

Figure 1: Example of the theory of change for sustainable food systems

Impact thesis

Phatisa’s impact thesis is integrated into its investment thesis. To this end, it primarily raises and invests funds to feed (SDG 2) and house (SDG 11) Africa, which is its strategic focus. The asset manager takes its fiduciary responsibility seriously: mobilising capital flows into African markets to unlock business growth in agri- and food-related investments, with some allocation to affordable middle-income housing. Focusing on Phatisa’s food funds (the major focus of capital allocation), its primary intention becomes evident: to contribute positively to building sustainable food systems in Africa. Sustainable food systems deliver food security and nutrition for all in such a way that the economic, social and environmental bases to generate food security and nutrition for future generations are not compromised.

To this end, Phatisa’s investment activities focus on:

- Economic sustainability: Ensuring financial success and building profitable businesses (SDG 8).

- Social sustainability: Phatisa prioritises inclusion, linking beneficiaries at the bottom of the pyramid ($3.65/day) directly to its business value chains, whether as suppliers (Goldtree, Goldenlay, Lona) or distributors (Goldenlay) or customers (Goldenlay, Meridian, FES, Rolfes and Deltamune). Linking in this way aims to establish enduring relationships and provide targeted support to, for instance, build capacity, provide last-mile distribution, develop and implement route-to-market strategies for BoP, and provide income-enhancing outcomes by, for example, increasing yields for BoP Generally, Phatisa seeks to build inclusive businesses which provide broad benefits to society (SDG 1), including supporting quality jobs (SDG 8).

- Environmental sustainability: Phatisa employs a robust ESG risk management system and even includes environment-specific clauses in shareholder agreements, such as zero-deforestation policies and action plans to mitigate the use of single-use Recent initiatives also include grant-funded support to companies for developing net zero business strategies in line with global climate commitments (SDGs 2, 6, 7, 12, 13, 14, 15).

The operationalisation of these focus areas is tailored to each investment. For example, in the case of food funds, the primary goal is the creation of sustainable food systems that deliver security and nutrition without compromising the needs of future generations. Activities here include creating avenues for last-mile distribution, route-to-market strategies for bottom-of-the-pyramid consumers and enhancing crop yields.

Linkages to global frameworks

Phatisa demonstrates an exemplary commitment to aligning its impact and investment strategies with global frameworks and standards. It has permanent, full-time capacity and competency to manage and deliver against its SDG-aligned impact goals, with three people in the Sustainability team responsible for ESG, impact and technical assistance (TA). ESG, impact and TA considerations are appraised in all stages of the investment process, from deal sourcing and origination, through deal scoring and screening, through due diligence, investment committee decision-making, inclusion of ESG and impact clauses in shareholders’ agreements and into the investment stage; while also considering sustainable impacts beyond exit.

To gauge the progress the company has made against its impact thesis described previously, Phatisa employs a formal system to guide the measurement, monitoring and tracking of impacts experienced by various stakeholders in the food and housing value chains. Distinct from its ESG management system, Phatisa’s Impact Measurement and Management (IMM) system serves as a comprehensive framework to guide impact assessment activities, monitoring and evaluation. It facilitates precise and reliable reporting, enabling it to determine the success of its impact goals and identify areas for improvement. The IMM system is structured around the five impact dimensions defined by Impact Frontiers, formerly known as the Impact Management Project. These dimensions – what, who, how much, contribution and risk – serve as the metrics against which the company maps the key impacts of each of its investments. Phatisa’s IMM system has received two independent evaluations from IBIS Consulting, both of which recognised it as a best-in-class management system.

Phatisa’s work directly resonates with specific SDGs such as SDG 2 (zero hunger), SDG 11 (sustainable cities and communities) and SDG 8 (decent work and economic growth). The company’s impact targets speak to the granular SDG targets, such as goal 12.3: “By 2030, halve per capita global food waste at the retail and consumer levels and reduce food losses along production and supply chains, including post-harvest losses”. It uses a blend of custom and generic indicators, informed by international frameworks such as IRIS+, HIPSO and the Joint Impact Indicators, for precise impact measurement.

Furthermore, Phatisa is a signatory to the United Nations Principles for Responsible Investment (UNPRI) and the Women’s Empowerment Principles, underlining its commitment to both sustainable investment and gender equality. Additionally, it is a long-standing member of the Global Impact Investing Network (GIIN) and has actively participated in advisory committees.

Impact

Phatisa portfolio companies have achieved the following key impacts to date:

- Directly produced 53 million (4,529,898) tonnes of food and food-related products in Africa;

- Provided 593 middle-income housing units and serviced plots in Kenya, Rwanda and Zambia;

- Supported 17,453 direct jobs (19% women) across three funds, with quality indicators assessed in every case and goals for stretching targets for diversity in leadership and employment, and the paying of living wages;

- Impacted at least 111,845 smallholder farmers and SME businesses in Africa, including: 13,735 BoP smallholder suppliers in Sierra Leone; 17,899 BoP smallholder suppliers and distributors in Zambia; at least 53,500 smallholder fertiliser customers in Malawi; and 4,538 smallholder mechanisation service recipients in Malawi; and

- Established carbon emission baselines at three of five PFF 2 portfolio companies, with plans to exit every PFF 2 portfolio company with a clear pathway to net zero by

As an active shareholder with a focused impact agenda, Phatisa believes that its intervention has been critical in achieving significant levels of impact. Its technical assistance (TA) funds have also played a catalytic role in certain cases. The company’s impact data and collection systems undergo independent biennial assurance, reinforcing its credibility. Looking ahead, it has set specific, multifaceted targets at both the fund and portfolio company levels, including those related to its technical assistance facility. These targets encompass a range of social, environmental and financial objectives, such as food production, waste reduction and emissions cuts. Phatisa is also part of UNEP’s Good Food Finance Network High Ambition Group and has publicly disclosed some of its fund targets, including those related to gender, at global platforms such as COP 27.

Financial performance

As a dedicated impact investor with about $425m in assets under management, Phatisa blends financial performance with transformative social and environmental impacts. Operating through three specialised funds – African Agriculture Fund, Phatisa Food Fund 2 and the Pan African Housing Fund – its investment strategy is grounded in the principle of creating “Impact & Returns”, which is also symbolised by the ampersand at the core of its brand. The company has observed a compelling correlation between financial success and impact – where the best financial performance has generated the most significant change. Overall, Phatisa has generated $3.18bn in revenue in African markets and contributed $31m in taxes.

Potential for replicability

Phatisa’s model, with its unique blend of financial performance and social impact, offers substantial potential for replicability across various sectors and themes, especially in supporting SMEs. However, certain challenges to scalability exist, including addressing market blockages such as commercial capital and financial performance. The replicability of the legal and capacity environments in Mauritius, where Phatisa is based, is also an aspect that requires further exploration.

Click here to download the case studyShare

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.