Impact investments require major effort from market enablers. This award recognises such enablers which include government departments, research firms, consulting firms, policy think-tanks and professional services companies that promote impact investments through thought leadership, project implementation and advisory work.

Impact Investing Ghana

Background

Impact Investing Ghana (IIGh) is the Ghana National Advisory Board for Impact Investing. It is an independent cross-sector initiative that promotes sustainable development and advances the development of the impact investment ecosystem in Ghana. IIGh is a member of the Global Steering Group (GSG) for Impact Investing, an independent global group that catalyses impact and creates awareness and engagement about impact investment and its potential.

Private-sector-led, yet in close partnership with the national government, IIGh raises awareness, creates market intelligence, drives collaboration to fill gaps in the ecosystem, changes policies and mobilises additional financial resources for the public good. It serves as a pivotal local platform, representing and uniting stakeholders from finance, business, government, social organisations and philanthropy. To this end, IIGh facilitates radical collaboration between all the key organisations in the impact investment ecosystem in Ghana.

Its impact areas include reducing poverty and driving jobs, reducing inequality (especially gender inequality), tackling the effects of climate change and making impact considerations part of the normal way of doing business in Ghana. IIGh has an ambitious plan to support the growth of impact ventures and to catalyse $1bn in impact funds for investment in impact ventures in Ghana and the West African sub- region.

Originality of design

Impact Investing Ghana showcases originality through its novel Fund of Funds initiative, Ci-Gaba. This model consolidates local institutional funding, targeting investments in businesses driving SDG attainment. By deploying a diversified investor base with varied risk profiles, Ci-Gava de-risks investments while addressing the financing gap for small and medium enterprises (SME) in Africa. Moreover, IIGh’s flagship programmes – ESO Collaborative and Dealsource Africa – are underpinned by a unique financial sustainability model. With the strategic use of catalytic capital for seeding and innovation facilitation, Ci-Gaba not only promises returns but also champions job creation, poverty alleviation and gender equality.

Meeting unfilled needs

Impact Investing Ghana addresses the urgent needs of financial access and support for local businesses aiming to achieve SDGs. Through its innovative Ci-Gaba Fund, IIGh strategically meets the glaring financing gap faced by SMEs in Ghana and West Africa, a region where the SME financing deficit is about $331bn.

The fund not only empowers businesses driving job creation, poverty alleviation and gender equality but also ensures substantial financial inflow into ventures promoting environmental sustainability. The design of Ci-Gaba is meticulously crafted to unlock local pension funds for investment, thereby serving the dual purpose of providing capital and ensuring sustainable, local investment practices. With a commitment to fostering impact at scale, IIGh’s interventions are not only filling financial voids but are also creating tangible social impact, epitomising a dynamic approach to meeting unfilled needs in the region.

Theory of change

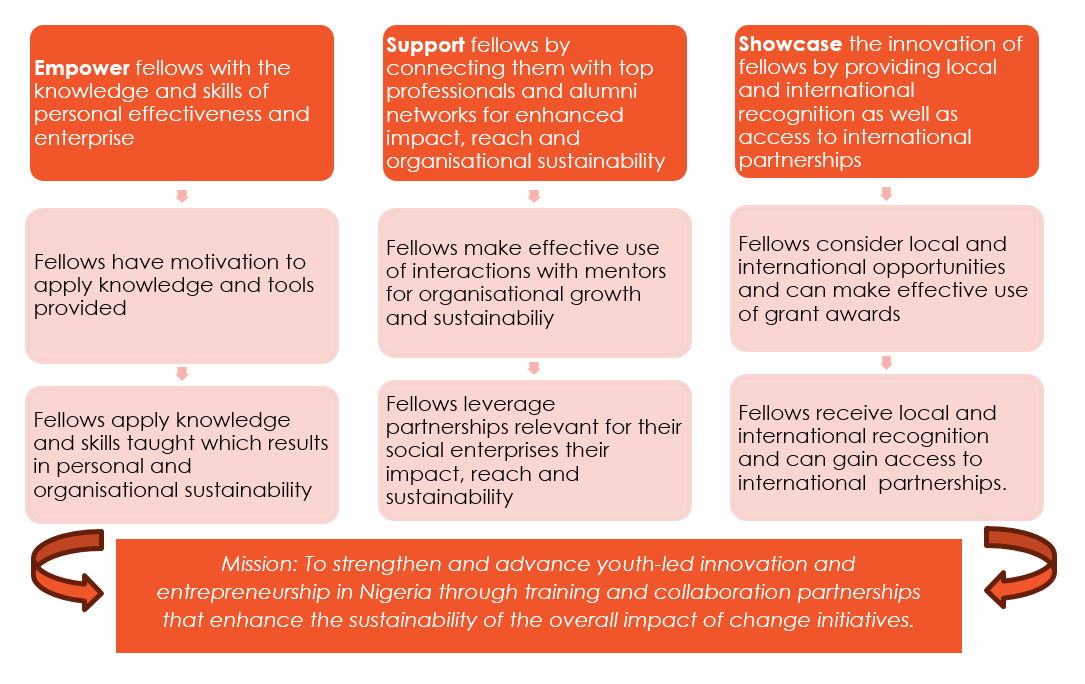

If IIGh continues to execute its strategic activities, which include conducting critical, locally relevant research, fostering capacity building and collaboration among ecosystem players and policy advocacy for impact investing, then these activities will lead to positive outcomes in vital areas. These areas include creating an enabling environment for impact investing and increasing access to capital for impact ventures and funds. The anticipated outcomes include increased employment, reduced inequality gaps and strengthened environmental resilience and low carbon development in the region, contributing substantively to the realisation of the SDGs.

The theory of change begins with the understanding that locally relevant research and tools are vital for driving policy and action as well as identifying ecosystem gaps. This knowledge base supports the capacity development of various ecosystem players, facilitating their ability to deploy capital effectively while promoting collaboration to scale impact. The resulting enabling legal, regulatory and economic environment would then encourage asset owners, investors and intermediaries not only to operate but to thrive in Ghana. With a strengthened ecosystem, IIGh endeavours to unlock $1bn in both local and international capital for the region, supporting the visibility and collaboration for impact ventures through various initiatives. This approach, underpinned by the strategic activities outlined, aims not only to bolster the impact investing ecosystem in Ghana but also to contribute significantly to the growth of impact investing in West Africa and globally.

Impact thesis

Impact Investing Ghana aims to address challenges that could lead to transformative social, economic and environmental outcomes. Its initiatives combine capacity building, collaboration and capital mobilisation to create a fertile ground for impact ventures and funds to grow and thrive. This coordinated approach aims to yield increased employment opportunities, narrow inequality gaps and foster environmental resilience and low carbon development in Ghana and the broader West African region, ultimately contributing to the realisation of SDGs.

Impact

Impact Investing Ghana has initiated transformative strides in improving lives and addressing social and environmental challenges in Ghana and West Africa. The organisation’s impacts are multifaceted and deeply ingrained in the investment ecosystem of the region.

Dedicated initiatives

Impact Investing Ghana’s initiatives, such as the Pensions Industry Collaborative and Impact Investing Leaders Forum, have played a pivotal role in bringing together industry leaders to develop strategic plans and overcome key constraints in the investment ecosystem.

Through these concerted efforts and strategic initiatives, IIGh has not only contributed to the strengthening of the impact investing ecosystem in Ghana but has also played a significant role in driving social and environmental impact in the region. The organisation continues to work tirelessly to ensure that investments are channelled effectively to solve pressing social and environmental challenges while generating financial returns for investors. These impacts collectively contribute to the creation of a more sustainable and inclusive economy in Ghana and West Africa.

Potential for replicability

- Scalable model: IIGh’s initiatives, such as ecosystem mapping and fostering industry collaboration, are scalable and can be replicated in other developing regions with similar socioeconomic The model is particularly applicable to areas seeking to strengthen their impact investing ecosystems and stimulate socioeconomic development.

- Public-private partnership: The organisation’s approach to working closely with both the private sector and the national government serves as a blueprint for fostering public-private Such collaborations are crucial for mobilising resources and creating enabling environments for impact investing.

- Innovative funding mechanisms: The introduction of innovative funding structures such as the fund- of-funds initiative and the focus on unlocking pension funding for impact present replicable solutions for financing in other regions facing capital

- Capacity building: IIGh’s emphasis on building the capacity of ecosystem players and promoting collaboration can be adopted by other national advisory boards and impact investing initiatives

- Engagement strategies: With strategies such as deal rooms for connecting funds to ventures and collaboratives for industry players, IIGh has devised engagement mechanisms that can be mirrored in different settings to foster connectivity and collaboration within the impact investing sector

Risks

Share

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.