Impact investments require major effort from market enablers. This award recognises such enablers which include government departments, research firms, consulting firms, policy think-tanks and professional services companies that promote impact investments through thought leadership, project implementation and advisory work.

IBIS Consulting

Background

IBIS helps its clients achieve their impact goals through an integrated approach to impact investing advisory and support. It works collaboratively with clients to establish and articulate their intentions regarding impact, and to embed these intentions into their daily work. IBIS’ mission is to maximise the impact created by clients by providing customised solutions, leveraging best practice methodologies and frameworks.

Originality of design

The solutions IBIS offers clients include impact policy and strategy setting, impact management and measurement systems and tools, impact monitoring, evaluation and reporting, as well as discreet services around impact due diligence, verification and assurance of impact systems and data, and impact training and capacity building. Through leveraging the skills and experience of its team, IBIS ensures that clients have the benefit of cutting-edge developments in key areas such as gender, job quality and climate. Core to the value that IBIS brings to its clients is its deep knowledge and sophisticated understanding of the financial sector, and the priorities of development finance investors in particular. This is coupled with appreciation for the nuances and complexities of the sectors and geographies in which they invest, achieved through its work and presence across the continent.

Meeting unfilled needs

IBIS provides advisory services to clients, the majority of whom seek to achieve both market-related financial returns and positive social and environmental impact. The company’s approach ensures that impact is integrated into the investment approach of its clients, so that financial success and impact are not mutually exclusive, and that the relationship between these priorities is tracked and understood. This expertise of the IBIS team is used to provide customised solutions that maximise the impact of client initiatives.

Theory of change

If IBIS continues to identify and build local talent to deliver market-leading ESG and impact advisory services to a growing number of financial sector clients in emerging markets, a meaningful contribution would be made to sustainable, inclusive growth in these markets, achieving measurable benefits for society and the environment.

Impact thesis

IBIS interprets and translates the priorities and realities of stakeholders in the impact investing universe to drive meaningful change. IBIS leverages its understanding of the impact landscape for the benefit of its clients and their beneficiaries by ultimately channelling greater amounts of investment capital to companies and projects that drive meaningful change. When IBIS’ clients generate impact through their investments, IBIS recognises that part of this is due to the guidance and support provided by its team.

SDG linkages

In addition to the SDGs in its work with clients, IBIS leverages various principles and standards, including IRIS+, the GRI, SASB, the Operating Principles for Impact Management, 2X Challenge, TCFD and SFDR, among others.

IBIS’ work primarily addresses SDG 8 (decent work and economic growth) and 10 (reduced inequalities). However, the work of the various companies IBIS works with addresses all the SDGs.

Impact

Because IBIS’ impact is largely achieved through the work of its clients, this is difficult to measure and quantify. However, the breadth of IBIS’ work through various sectors and countries across the continent gives an indication of the extent of the organisation’s impact.

As one of the largest specialist ESG and impact advisory firms in Africa and Asia, IBIS has successfully completed more than 1,000 projects in more than 75 countries, most of which are in Africa. Its expertise spans a wide range of sectors, including engineering, manufacturing and industrial, power and utilities, education, food and beverage processing, agriculture and forestry, healthcare, chemicals and pharmaceuticals, and infrastructure and transportation. A key differentiating factor for IBIS is its holistic approach to weaving impact across all its services. As already mentioned, IBIS leverages a range of principles and standards, including IRIS+, the GRI, SASB, the Operating Principles for Impact Management, 2X Challenge, TCFD and SFDR, among others.

IBIS intends to contribute towards inclusive growth in emerging markets through profit-driven investment and business activities that seek to avoid harm and actively drive benefit for society and the environment. The company recognises that the development and growth of impact talent in the emerging markets where it operates is essential to achieving this objective, as well as the objectives of its clients. For this reason, IBIS is committed to building a diverse cohort of local talent which understands and is able navigate the intricacies and nuances of these regions.

In the case of IBIS’ work, additionality is difficult to quantity. However, there is a strong sense among its clients that IBIS plays a unique role in the market through:

- Focusing almost exclusively in the financial sector, meaning that clients are able to access deep and broad sector knowledge and experience

- Leveraging senior team members and deep technical expertise

- Ensuring a holistic approach to sustainability and integration of various skills and services to deliver relevant, bespoke solutions

- Ensuring that most of IBIS’ team remain based in Africa to maintain familiarity with the challenges and opportunities evolving on the continent

- Remaining abreast of the evolution of best practice in ESG and impact and integrating this into the work the company does

For these reasons, it is IBIS’ conviction that much of the impact achieved through its clients’ work would not have taken place, or have been of an equivalent depth/breadth, had it not been for their partnership with IBIS.

The fact that IBIS works both in more traditional ESG and in impact means that ESG risk mitigation is built into IBIS’ approach for maximising impact. IBIS understands that ineffective or insufficient identification, management and mitigation of risks will limit, erode or completely negate any impact achieved, highlighting the importance of taking a holistic approach to sustainability.

IBIS has been in operation since 2016 and continues to expand. This proves the longevity of its model. That the company operates in numerous countries is proof of the scalability of its intervention. Additionally, the variety of the companies that IBIS services also indicates the scale, depth and duration of IBIS’ work. The fact that IBIS has completed more than 1,000 projects in more than 75 countries, of which most are in Africa, suggests that the dimension of impact to which IBIS contributes most directly is that of breadth. In supporting the expansive work of its clients, IBIS can reach a large number of beneficiaries across sectors and geographies.

The main risk associated with IBIS’ work is linked to drop-off, as there are cases in which IBIS has limited interactions with a client post-engagement. To mitigate this:

- Projects are carried out in a collaborative manner, ensuring the client is part of any solutions developed

- Capacity building (both formal and informal) takes place in all engagements

- IBIS is intentional about embedding ESG and impact practices into the existing day-to-day work of clients’ businesses, increasing the chances of this type of thinking being integrated over the long term

- Consideration is always given to ensuring that deliverables are relevant, practical and fit for purpose so that an implementation can be led by clients post-engagement

- In many instances, IBIS works with clients on a retainer basis to provide ongoing support

Financial performance

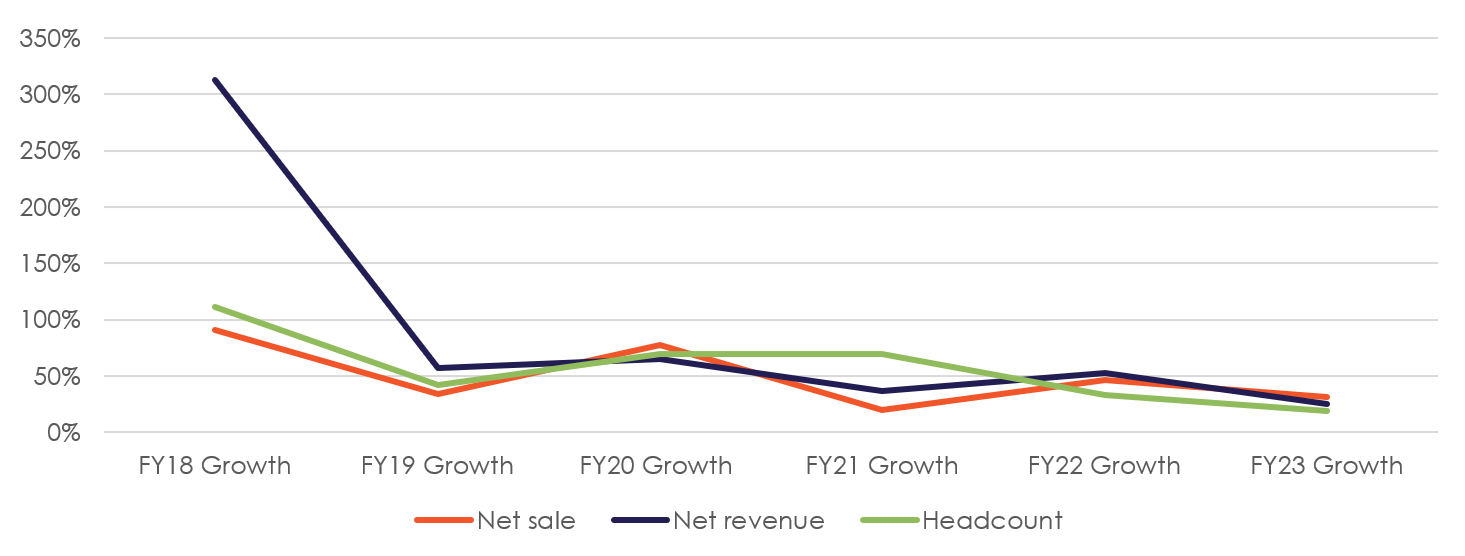

Since its inception, IBIS has consistently been able to achieve revenue and profit growth year on year, indicating that the business model is financially viable and that the impact it achieves grows in tandem with the financial performance it generates. The table below illustrates the compound annual growth rates (CAGR) for different key performance indicators over the fiscal years 2018 to 2023. The figures provided highlight the significant growth achieved by IBIS.

Figure 2: Compound annual growth rate: IBIS Consulting

| CAGR | |

| Net sale | 48% |

| Net revenue | 74% |

| Headcount | 45% |

IBIS’s financial sustainability is rooted in its robust and proven business model. Over the years, the company has demonstrated its capacity to achieve and even exceed its target revenue and returns. The impressive growth showcased through consistent compound annual growth rates from 2018 to 2023, as illustrated in Figure 2, underscores this achievement. The company’s financial sustainability is further evidenced by its capacity to simultaneously drive financial growth and generate meaningful impact, creating a virtuous cycle that reinforces its position in the industry. The alignment between financial success and impact underscores IBIS’s holistic sustainability.

Potential for replicability

The growth of IBIS, evidenced by its growing employee base (now nearly 100 employees) and its establishment of offices across various geographies (including South Africa, Kenya, Morocco, Egypt, France, Singapore and Hong Kong), serves as a testament to the replicability and adaptability of its business model. This highlights the capacity of diverse stakeholders across various sectors and markets to successfully adopt and implement IBIS’s business approach.

Although IBIS primarily focuses on the financial sector, the companies it works with do work across various industries. IBIS’ work is therefore transferrable to a variety of sectors.

Risks

Recognising the specialised nature of the impact investing field and the limited availability of skilled professionals, IBIS is dedicated to scouting and attracting the best talent in this sector. IBIS focuses on external recruitment but also emphasises nurturing and growing talent within the company. Committed to providing a conducive working environment that fosters learning, innovation and professional growth, IBIS ensures that its team members stay at the forefront of the evolving impact investing landscape, collectively contributing to the goal of creating meaningful and lasting impact through their work.

Click here to download the case studyShare

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.