This award is for an individual that has made an outstanding contribution in the past year to support the growth of the impact investments ecosystem.

About

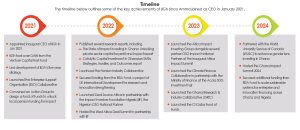

Amma is a celebrated trailblazer in the West African impact investing ecosystem and has served the market in numerous capacities in recent years, including as CEO of Impact Investing Ghana (IIGh). Amma has established several programmes such as the Enterprise Support Organisation (ESO) Collaborative, Ghana Research and Industry Collaborative (GRIC), Deal Source Africa and Pensions Industry Collaborative that tie into IIGh’s five-year strategy for impact.

She also has an impressive track record of building and maintaining partnerships with the likes of the RISA Fund, UK International Development, UN in Ghana, WFP, Orange Corners, ANDE, BII, FMO, and Ford Foundation.

IIGh has contributed significantly to the development of the impact investment market in Africa, including through a report published in 2022 in which IIGh identified 10 critical gaps in the impact investing ecosystem, their causes and consequences, then crafted proposed solutions, presenting its innovative nucleus of change model.

In her capacity as CEO of IIGh, Amma has spearheaded the development of the organisation’s five-year strategy. Her targeted and solutions-based approach with sustainability and impact at the centre enables the design of interventions that will support IIGh with its ambition to unlock $1bn in impact investing capital for West Africa.

Her deep expertise in the regulatory environment, policies and ESG standards enhances the robustness of the initiatives and ensures they are designed to achieve long-term objectives.

Delivering real-world impact

Amma has been instrumental in designing many of the interventions outlined above as well as other initiatives and some of the key impacts from the establishment of these include:

- The setup of the GRIC research brief template which is a tool/resource anyone can adapt.

- Organising the first GRIC annual forum that brought 128 personnel committed to bridging the gap between research and industry.

- Helped mobilise impact investment funding of $1,723,903 for six businesses through the Deal Source Africa programme in Ghana.

- Building the enterprise support space in Ghana and connecting them with quality improvement programmes per the SCALE program by Argidius Foundation.

- Building capacity for over 200 fund managers and transaction advisors in Ghana in partnership with the British International Investment

- Equipping over 100 pension trustees with the knowledge and skills needed to evaluate alternative investments and valuable insights to empower them to make informed decisions in their investment journeys.

Ensuring scalability

Many of the interventions designed by Amma can be replicated in other jurisdictions. For example, both Nigeria and Ghana face challenges in providing innovative ventures with adequate access to patient capital as an estimated $5bn financing gap exists annually for SMEs in Ghana, and a staggering $32.2bn for micro, small, and medium enterprises (MSMEs) in Nigeria. The lack of a robust pipeline of investment-ready businesses stems from the inadequate capacity and inconsistent quality of enterprise support organisations.

Additionally, there is a scarcity of transaction advisory services and efficient channels to connect businesses to investors. With this insight, ESO Collaborative Nigeria and Deal Source Africa Nigeria will be rolling out this year with support from The RISA Fund.

Amma’s leadership at IIGh demonstrates the potential of impact investing to address critical social and economic challenges. By fostering collaboration and innovation, IIGh is playing a key role in building a more sustainable and inclusive future for West Africa. The lessons learned from their work can be applied in other regions to further advance the field of impact investing.

Share

This research report was issued by Krutham South Africa Pty Ltd.

Krutham aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments.

The information contained in this report is based on sources that Krutham believes to be reliable, but Krutham makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information and opinions could change at any time without prior notice. Krutham is under no obligation to inform any recipient of this document of any such changes.

No part of this report should be considered as a credit rating or ratings product, nor as ratings advice.

Krutham does not provide ratings on any sovereign or corporate entity for any client.

Krutham, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Disclosure

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Krutham group entities.

Krutham staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Krutham’s code of conduct which can be obtained by emailing mail@krutham.com.

Krutham may have, or be seeking to have, a consulting or other professional relationship with the companies, sovereigns or individuals mentioned in this report. A copy of Krutham’s conflicts of interest policy is available on request by emailing mail@krutham.com. Relevant specific conflicts of interest will be listed here if they exist.

- Krutham provides independent advice and independent research to a wide range of investors and financial institutions on Eskom, Denel, Transnet, Land Bank and SAA. Krutham’s interactions with all clients on Eskom, Denel, Transnet, Land Bank and SAA may include business confidential information but does not include MNPI and so does not provide a conflict. Krutham does not ‘act’ or ‘advocate’ for or ‘represent’ any of these clients. Krutham has regular interactions with government, Eskom, Denel, Transnet, Land Bank, SAA and other related entities connected with the SOE situation but does not provide paid consulting services or paid advice to any of these entities. These interactions are governed by Krutham’s own conflicts of interest policy as well as secrecy rules of the respective institutions or state-owned companies.

- Krutham provides a range of services into ‘organised business’ groupings in South Africa, which includes independent bespoke research and advice. Krutham is compensated for these services. Krutham does not ‘act for’ or ‘advocate’ for or ‘represent’ any of these clients.

- Krutham is currently involved in policy design work on a number of government priorities.

Copyright © 2023. All rights reserved. This document is copyrighted to Krutham South Africa Pty Ltd.

This report is only intended for the direct recipient of this report from a Krutham group company employee and may not be distributed in any form without prior permission. Prior written permission must be obtained before using the content of this report in other forms including for media, commercial or non-commercial benefit.